Starting a new business that involves importing can seem like navigating through a maze with its customs procedures, documentation requirements, and regulations. Understanding these aspects is crucial to avoid delays, extra costs, and legal issues. Aidock’s services streamline this process, making importing easier for new businesses by offering solutions that efficiently navigate customs clearance complexities.

Understanding Customs and Relevant Agencies

Customs authorities, like the U.S. Customs and Border Protection (CBP), play a pivotal role in the import/export process. They ensure that goods entering the country are legal, collect import duties and tariffs, and enforce regulations on behalf of other government agencies. Familiarizing yourself with CBP operations and utilizing their resources for new importers can be highly beneficial.

Several other agencies may also be involved depending on the nature of the imported goods. For example, the Food and Drug Administration (FDA) oversees the safety of products such as food and medical devices, while the Environmental Protection Agency (EPA) regulates items that might harm the environment. It’s essential to check if your products fall under the regulations of these or other agencies and comply accordingly.

Customs Clearance Process

The customs clearance process involves several steps, starting with the inspection of documents such as invoices, packing lists, and bills of lading. Accurate and complete documentation is crucial for a smooth process. Following documentation inspection, any taxes or duties owed on the imported goods must be paid before they are released for delivery.

Taxes and duties depend on factors like the goods’ value, type, and origin. Staying informed about these and ensuring payments are made promptly can prevent delays. Preparing for potential issues like documentation errors, product restrictions, and volume surges during holidays can help you navigate customs more effectively.

How Aidock Can Help

Aidock is a B2B service that helps customs brokers and brokerage firms with importing goods by providing solutions that make navigating customs procedures easier. Our services aim to simplify the complexities that new businesses face when importing, from ensuring accurate documentation to understanding and preparing for duties and taxes.

FAQ

1. What is customs clearance, and why is it essential for my business?

Customs clearance is declaring goods to customs authorities as they enter or leave a country, ensuring all applicable duties and taxes are paid and that the goods comply with local laws and regulations. Businesses must avoid legal issues and ensure smooth delivery of imported goods .

2. How can I determine the taxes and duties I owe on imported goods?

The amount of taxes and duties owed depends on several factors, including the type of goods, their value, and their origin. Familiarizing yourself with the Harmonized Tariff Schedule and consulting with a customs broker or using an import/export tool offered by shipping companies can help you accurately calculate these costs.

3. Do I need a customs broker to import goods into my country?

While using a customs broker is not legally required, hiring one can simplify the import process. Customs brokers are licensed professionals who can represent importers in transactions with customs authorities, ensuring that all necessary documentation is accurate and compliant, which can be especially helpful for new businesses unfamiliar with customs procedures.

4. What documents are essential for importing goods?

Critical documents for importing include the bill of lading, commercial invoice, packing list, and possibly a certificate of origin, among others. These documents should accurately describe the goods’ quantity, weight, and value and include information about the sender and recipient.

5. How can I ensure a smooth customs clearance process for my imports?

Ensuring a smooth process involves:

- preparing accurate and complete documentation

- understanding the taxes and duties applicable to your goods

- staying informed about international trade laws

Additionally, considering the goods you’re shipping and consulting with experts like customs brokers can help navigate the complexities of customs clearance.

AiDock

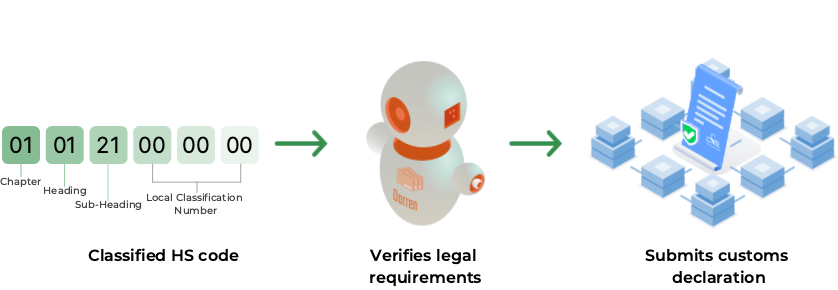

Darren | Compliance

The process involves a thorough examination to confirm that all legal prerequisites are met and taxes are appropriately applied, all based on the specific HS code assigned to the product. Once this verification is complete, a meticulously prepared customs declaration is submitted.